Challenger bank launches a new product feature. Major hire for regtech disruptor. Series B fundraise for payments provider. Savings app onboards 50,000th customer.

These aren’t real headlines, but they easily could be. For fintech startups, corporate announcements play an important role in creating a drumbeat of news. They are a crucial ingredient in building awareness and credibility, particularly in the tricky first few years as a new brand is launched into the world.

As part of Headland’s recent research into the role of hype in fintech we used analytical tools to track the ongoing levels of conversation about a series of brands across earned and social media. Naturally when reviewing this kind of data our attention is drawn to the big spikes in conversation, and perhaps not surprisingly, big corporate news moments were nearly always the cause of the spikes.

However, it was more revealing to see what happened to the level of conversation outside of these. Ultimately, hyped brands need to be talked about by others, not just themselves. This means getting media coverage outside of when you’re out there proactively saying something: achieving volume without always having to be the driver of the conversation.

For brands, this means no longer being reliant on proactive announcements to generate cut through and awareness. We’ve termed this idea of rapidly increasing conversation ‘about’ a brand, rather than ‘by’ a brand, escape velocity.

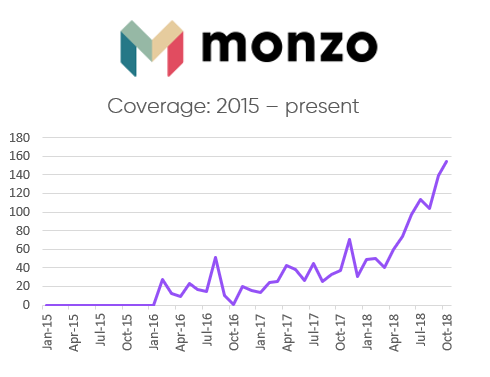

Of course achieving this can bring other benefits too, in reaching new audiences and increasing visibility beyond the enterprise pages or the tech-focused trades: Monzo’s hot coral card has featured in the Sunday Times Style magazine while eToro has been quoted in Vanity Fair on the market for cryptoassets.

Comparing the media mentions of a number of high-profile fintech brands we found a crucial difference between them was whether they generated this discussion beyond corporate news moments.

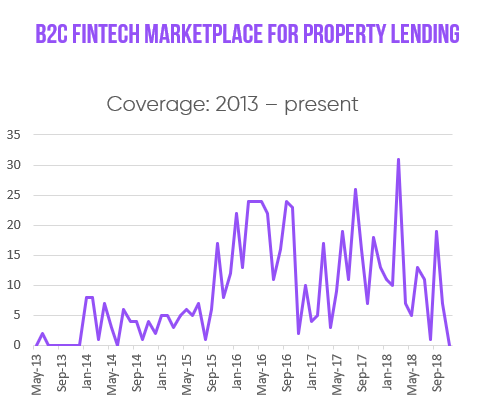

One firm, a B2C marketplace for property lending, saw regular, steep spikes in coverage over three years, but lacked any overall upward trend: at the end of the period, the number of mentions had fallen back to near zero, reflecting a failure to build a bigger narrative.

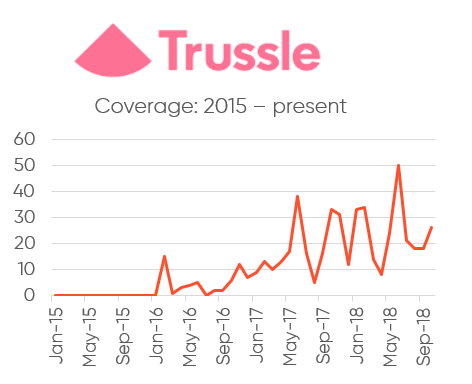

In comparison, hyped brands like Klarna, Trussle and Monzo saw a sustained upward trend, with each ‘spike’ contributing to a continuous rise in coverage over time.

So, what does this all mean for fintech start ups?

A lot of focus (and pressure) tends to fall on communications teams in the run up to announcements, but our research suggests that a better determinant of success over a longer period is being able to generate coverage outside these.

As well as doing the basics brilliantly like building strong media relationships, our findings show the importance of using the big moments to establish and build on a common themes and messages. This could be identifying and challenging an enemy, like Transferwise did in its early days, in training its crosshairs on the incumbent banks and seeking to demonstrate how they were shortchanging customers.

By generating a healthy stream of incoming press inquiries brands are able to achieve a rise in engagement commensurate with the business’ growth in other areas such as investment, customers, employees or revenues.