Investment trusts struggled last year with rapid interest rate rises depressing the appeal of dividend yields in relation to bonds while also hitting private equity, real estate and infrastructure assets. Discount rates have widened, with the AIC average at 16.9% to NAV, the largest since 2008. Yet despite the volatility of interest rates and inflation, investment trusts still offer significant advantages, from the ability to smooth, incremental dividend growth over time, to investing in high potential private assets that are otherwise unavailable to retail investors.

Meeting these challenges cannot just be a matter of waiting for performance to improve. The investors who drove heavy discounts by selling out are unlikely to come back in a hurry, and trusts need to compete against open-ended funds for new investors, particularly passive funds with their significantly lower charges and larger marketing and communications budgets.

Headland has worked with several trusts over the last few years. Based on our experience, there are three key questions that boards should be asking their marketing and communications teams right now.

1. Are we clear on our target investors?

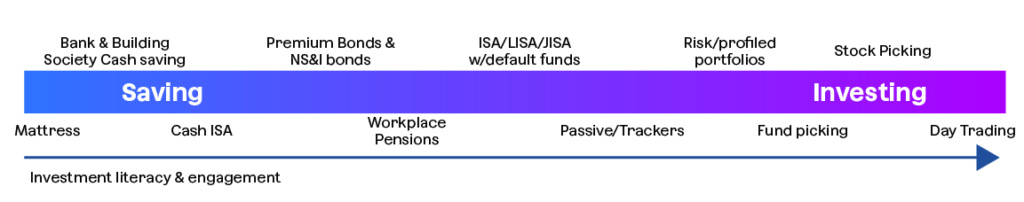

There are many kinds of investors, from institutions to wealth managers to retail investors. The latter are often the most important for trusts, yet within that group, there is a huge spectrum from saving to investing, where knowledge, engagement, investment size and risk appetite all differ.

Every trust should have a bullseye for who they are targeting as new investors and where they sit on that spectrum. Are they older, experienced investors with complex, diversified portfolios or younger investors with perhaps just a stocks and shares ISA? If a combination, what is the order of priority?

2. Are our marketing and communications focused on those investors?

Results, AGMs and annual reports are the bedrock for company communications with existing investors and the media. However, in our experience, many trusts default to PR and marketing outside of these events which targets the same people – ‘the usual suspects’ who are already engaged, follow investment media and are easy to identify and reach.

For many trusts, existing investors may fall into a different demographic from the new investors they want to attract. If this is the case, boards need to be asking how their marketing and communications activity add up to an integrated and effective programme that speaks meaningfully to both.

3. Are we engaging them effectively and efficiently?

Different investors read and follow different media – Headland, using YouGov’s Profiles database, has identified two important but very different groups of investors.

- Existing Investment Trust investors: older, wealthier and much more likely to read investment specialist media and personal finance columns. However, nearly 65% of these investors also use Facebook, which is a significantly higher penetration than any newspaper.

- General investors: who hold stocks and shares ISAs but do not hold investment trusts – the group that many trusts want and need to attract. These people are younger, less engaged and much less likely to read or follow investment media or commentary. In fact, over 20% of them don’t regularly read a newspaper at all for news – let alone investment advice.

Younger investors are accumulating wealth, while older ones are spending more time online. Yet most trusts are struck in a formulaic approach, blind to whether their messaging resonates, let alone whether it is delivered to the right audiences through the right channels. Boards should be more ambitious. The communications environment may be fragmented and challenging, but it presents more opportunities than ever before for trusts with the foresight to seize them.

Read more Insights & News